What Is Identity Theft & How Can You Protect Yourself?

This post may have affiliate links. Please read the Disclosure Policy for complete details.

Identity theft is a scary concept: the idea that someone else can be you!

At least on paper.

Want to know the scariest part?

You most likely won’t find out until it’s already too late.

Creditors don’t report info right away, while some don’t report activity for two months.

The thief can be long gone by that time.

And know this:

Identity theft isn’t only about accessing your financial information.

They can use your identity to obtain a driver’s license or a cell phone account.

Things that don’t hit your credit report or at least won’t for a while until it goes to collections.

The best way to protect yourself is to be diligent about how you handle your identifying information.

Limiting the documents that are available to be lost or stolen, and not allowing them to fall into the wrong hands is the best way to protect yourself against identity thieves.

But, it’s not just about hiding the major things.

There are many ways in which prospective identity thieves can get a hold of the things they would need to make your life a living hell.

These tips and resources will go a long way in helping you to keep your identity (and money) your own, so let’s get started…

What Is Identity Theft?

You know, that’s a great question and the best place to start this whole discussion.

According to the US Department of Justice:

Identity theft and identity fraud are terms used to refer to all types of crime in which someone wrongfully obtains and uses another person’s personal data in some way that involves fraud or deception, typically for economic gain.

United States Department of Justice, Fraud Section

Simply put, identity theft is anytime someone uses your information to:

- Open a credit card or bank account

- Get a driver’s license/ID card

- Obtain medical services

- Open a utility account

The majority of ID theft cases do involve monetary gain as the DOJ states.

There are, however, instances where identity theft isn’t just about money, as we’ll discuss later on.

How To Prevent Identity Theft

Sadly, there is no such thing as an absolute way to prevent identity theft.

Anyone can be a victim of ID theft, which is why it’s so important to inform you of the different methods you can use to prevent it.

No one method we will discuss will be as good as combining several–if not all–methods.

So, without further delay, let’s discuss how to prevent identity theft.

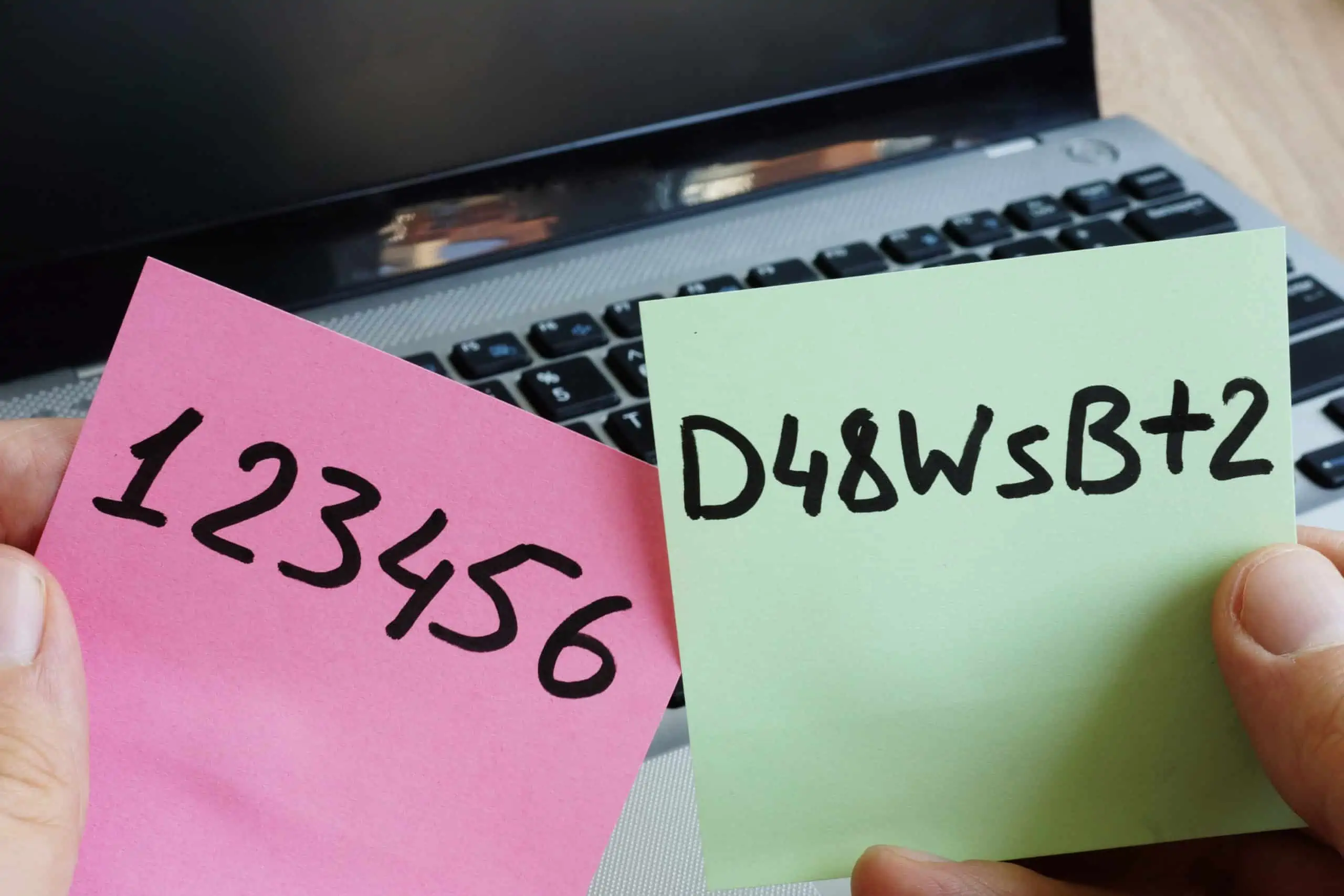

Use A Password manager

Hopefully, we’re all a lot more aware of the importance of varying our passwords today.

“Hopefully” is the keyword…because there are always people who do what they please regardless of the warnings.

Oh, I live in a decent neighborhood, I don’t have to lock my car doors.

It’ll be an easy test, I don’t need to study.

They always exaggerate about hurricane season, I don’t have to do anything to prepare.

Most people unti it’s too late

And then what happens?

- The car gets broken into…

- They fail the test…

- A hurricane makes landfall in that area…

- Whatever they think is the case ends up flipped on them!

Or they are so smitten with someone they have only had a first date with that they already are giving that person their streaming service password ????

It never fails, we always think we know better than the people who actually do.

So, when it comes to keeping our online lives secure, I’m sure many of us still think it’s ok to ignore the experts.

That is until you get that letter or email saying there was a security breach at your credit card company or you get collection calls for accounts in your name that you didn’t open.

So what can you do?

For starters, get a good password manager such as LastPass!

LastPass stores your passwords securely so you don’t have to use the same on every site.

LastPass also has a built-in generator so you don’t have to worry about what passwords to use.

It works on desktops, laptops, tablets, and phones so you always have your passwords handy and don’t have to carry around a cheat sheet which is the least smart thing you could do besides using a single password for every site.

I use it for all of my stuff–both personal and business-related and I swear by it!

Credit Monitoring Services

No doubt you’ve heard about these services promising to protect you from identity theft at some point.

The advertisements are practically everywhere:

- Cable television

- Internet

- Magazines

- Newspapers

- Credit card providers

- Banks

- Social media

There are, in fact, many benefits to using a credit monitoring service such as LifeLock.

You have a system looking out for new instances of your name or social security number being used which is something you can’t dedicate too much time toward on your own.

They also have plans to monitor your credit reports at one or all three credit reporting bureaus.

LifeLock even has plans that monitor investment account activity for identity theft.

Then there are the reimbursements for stolen funds and the expenses incurred to recover your stolen identity.

That varies from $25k up to $1m depending on your membership plan (and of course, there are going to be certain terms and conditions in their legal statement).

I won’t lie, the best LifeLock plans aren’t cheap by any means.

But it is an extra layer of protection and support if you can afford it, and you know the old saying–you get what you pay for–so if you want the best service you, unfortunately, will have to spend some money.

Unfortunately, a credit monitoring service alone will not do.

Similar to the way that exercise alone won’t help you get fit if you have bad diet habits, a credit monitoring service alone won’t protect you from becoming an identity theft victim.

It all starts with you having good habits when it comes to personal information.

Phishing Scams

It’s getting harder to tell what’s real and what’s fake these days.

Is that email real or is it a phishing scam attempt?

Is that phone call really from who it says it’s from?

It’s ok to be skeptical.

New online scams, mail, and telephone schemes seem to pop up every day:

- Suspicious activity on Apple iCloud accounts

- Windows tech support phone scam

- Impostor IRS agent tax threats

- Bank phishing emails

- Neighborhood phone number spoofing

- Fake 1099-NEC forms

There are some pretty big names there, right!?

What are you supposed to do when it all seems so legit?

Here are a few points to keep in mind regarding phishing scams:

- The IRS never initiates contact via phone so you should always ignore those types of recorded messages.

- Apple and Microsoft tech persons will never call you so ignore those as well.

- If you receive any emails from a bank, call the general 800 number to find out if they really need any info from you.

- Banks will never ask you for your username or password so ignore any inquiry in that regard.

- Never click on any link in emails that you have any suspicion about.

You can even visit a bank branch or a local IRS service center if you want to make sure that communication is legit.

Social Media Profiles

Facebook is great!

It keeps you connected with your friends and family.

It allows you to reconnect with people from your past.

It helps you network.

Unfortunately, it also helps criminals who are looking to steal your identity.

How?

Your profile…you give them all kinds of info:

- Hometown

- Date of birth, or

- Birthday combined with graduation dates and schools

These items give thieves plenty to go on if they are trying to steal your identity.

Think about it: if they have your date of birth outright, that’s one major component.

But if they have your birthday and know when you graduated high school, they can put two and two together to get your DOB (assuming, of course, you graduated “on time”).

The other pieces are also items that go into identity theft.

Your hometown or city of birth is oftentimes a security question.

So is your elementary/middle school name or city of birth.

I know it’s tempting to fill out profiles completely so people from your past can find you.

What about the people who you don’t actually know?

You know, those people who you meet briefly at a networking meeting or a friend of a cousin that you met once.

A lot of people use their personal social media profiles for business as well.

So sure, you may trust your friends, but not everyone who can see your info is a friend…

Or trustworthy!

Check Your Credit Report

Most identity theft revolves around finances.

In that regard, it’s vital that you stay on top of your credit report.

I’ll say it again–your credit report.

Not your credit score!

A lot of people worry about the score, but the report is what will tell you if there’s anything amiss.

You’ll be able to see if there were any inquiries made which should be a huge red flag if you didn’t apply for any credit.

You’ll also see all of the open credit lines in your name:

- Bank loans

- Mortgages

- Credit cards

- Auto loans or leases

- Student loans

If there’s anything that you don’t recognize, you’ll immediately want to reach out to that creditor.

Now more than ever it’s easier to keep track of your credit report.

Apps and websites such as Credit Karma are to thank.

With Credit Karma, you not only get your credit score, but you also get full access to what’s contained in your credit report as well.

It used to be that you could only get your one free annual credit report and then you’d have to pay for any other.

Unless you are the victim of ID theft or are denied credit, in which case you get one free with proof.

The best part, other than Credit Karma being free is that it doesn’t affect your score when you check your own info!

So feel free to check your credit report as often as you want to make sure you’re the only one using your identity.

Secure Important Documents

There are almost no reasons to carry around any identification other than your driver’s license (or non-drivers license as the case may be).

That means you should never be carrying around your:

- Social security card

- Passport

- Birth Certificate

Plus, think about how easy it is to lose a purse or wallet.

Or how easy it is to have those items stolen or lifted while out on the street.

But let’s take it one step further:

If you don’t need them regularly, these documents should never be kept in your home either.

They are simply too important to leave for anyone to be able to access.

I mean, with any of those documents in the hands of an identity thief, that’s all they need to “become” you to any financial institution or government entity.

Instead, keep them in a bank vault or safety deposit box.

Unless you live in the boonies, there is almost certainly a bank near you.

The fees for a small safe deposit box shouldn’t be too cost-prohibitive and can be even cheaper based on your relationship with the institution.

And don’t think that having a home vault is more secure.

Forget about the fact that a safe can be cracked.

Even if you are burgled by rank amateurs, a lock-box or small/medium-sized safe can be hauled away to be broken into at a later time.

Safe deposit boxes are much more secure while offering ease of access to keep your identifying documentation safe and secure.

Review Bank & Credit Card Statements

One thing many people forget about is existing accounts.

While identity theft isn’t always about financial fraud, when it is, it isn’t always about opening new accounts.

Sometimes, it’s about getting access to existing accounts.

Why?

Most people aren’t as careful with their existing accounts.

We get a statement and it goes right into a pile with the rest of the mail.

If we opt for e-delivery, it’s even worse since we are even less likely to log into our accounts to scrutinize the line items.

Criminals know that a few smaller transactions a month are more likely to go unnoticed.

One way to make sure you aren’t a victim of identity theft is to monitor your accounts for fraudulent activity.

At the very least, review your bank statements as well as your credit card statements.

If you want to be more proactive, log into your online banking account and review the recent transactions so you may catch them sooner than later.

It only takes a few minutes but the time will be well-spent, especially when you think about how much time recovering from identity theft will take!

Gmail (& Other Provider) Email Security

Email is great.

It cuts down on communication time and allows us to share documents and pics with our friends and family.

It also helps us perform business and personal financial tasks much more efficiently than postal mail.

However, it’s not infallible…email can be hacked and your accounts compromised.

You should never send anything with identifying information via email.

You should especially stay away from that practice on public WiFi, no matter how “secure” it seems.

When it comes to working with professionals you should also be cautious.

Make sure they aren’t using email to exchange anything with your information that can lead to identity theft in the wrong hands.

As a tax accountant, I use a secure portal system with bank-standard AES-256-bit encryption.

When a client has to send me bank statements or tax documents, or when I send them their income tax return, I always use the portal.

I will never put my clients’ information in jeopardy of being accessed by potential identity thieves.

Your attorney, tax professional, or other professional partners should take the same precautions to protect your identity as well.

If not, you may want to consider changing partners.

Identity Theft + Postal Theft

This isn’t a knock on the USPS.

It’s just a simple truth:

It’s easier to steal your information from your mailbox than it is to get it any other way.

Take your own mailbox for example:

How difficult would it be for someone to simply walk up to your box, open it, and grab what is inside?

What if you paid your bills via your bank’s bill pay service?

Or if you went directly to the provider website to pay your credit card statement, mortgage payment, utility bills, etc.?

How difficult do you think it would be to access your information that way?

I’m pretty sure the latter is exponentially more difficult to do.

The same goes for your income tax returns or documents from when you run payroll like your W-2 or 1099-NEC.

Even if you live in an apartment or condo with a locked mailbox–those aren’t the most secure.

That’s one of the most important benefits of filing your taxes online–the security aspect of your personal info.

Leave the snail mail for the junk offers and the store circulars; keep your important personal info strictly electronic to add an additional layer of identity theft protection.

Check Website Security

Not all websites are created equal.

Some are just run by people who don’t know any better regarding website security.

Others are purposefully malicious.

One of the most common pieces of advice concerning surfing the web is to look for the closed lock on the address bar.

Now, even scam websites are “secure”, meaning they have a certificate that gives the closed lock you were told to look for.

If that’s the case, then how do you know if you are on a legitimate website?

The easiest way is to go directly there in a new browser window.

It doesn’t matter if there was a link in an email, or via a search result…

Always go directly to the site itself by typing in the address so you know you will be getting the real thing.

Social Security + Identity Theft

I mentioned previously that not all identity theft involves gaining access to your money.

In fact, a lot of ID theft cases involve getting access to your information for less nefarious reasons.

Sometimes, people want to escape their current identity so they get hold of someone else’s information and assume their identity.

It can be for something as simple as being an ex-convict and being unable to secure a job due to their past.

You can find out if this is happening to you by registering for a “my Social Security” account.

If you don’t know what that is, it’s a database that tracks the money you’ve earned in your lifetime for calculating different Social Security payouts.

You can see how much income has been reported under your social security number and match it against your tax returns or W-2 history.

If there are any discrepancies, it could be a simple error or possibly a sign that someone has gotten a hold of your information and is living as “you”.

From there you can report the identity theft to the Social Security Administration for further examination.

You can even add a block onto your account to prevent anyone (including yourself) from changing any info via the internet and being required to go to a Social Security service center in person to do so.

Shred Your Documents

This is pretty much a no-brainer in this day and age.

Nothing with any kind of identifying information should be thrown out.

When it comes to shredding, strip-cut shredders are not acceptable anymore.

Cross-cut, diamond-cut, or micro-cut is the only way to go.

Strip-cup shredders only make it slightly more difficult for identity thieves to gain your info…it’s like putting a puzzle together with large pieces.

If you don’t want to purchase one outright, you can check with your closest office supply store which should offer shredding services for a small fee.

Also, contact your city/county as many hold free “shred days” and even check with your bank to see if they offer any kind of shredding service.

The bottom line is that if you have any paper documents you want to be sure that you are taking every precaution when it comes to destroying them.

What To Do IF You’re An ID Theft Victim

This can never be understated: being a victim of identity theft sucks.

It’s important to keep your cool if you ever find that your identity has been compromised.

If you are ever a victim of ID theft in the future, be sure to follow these steps to report identity theft and begin the recovery process.

Document The ID Theft Details

The first thing to do is to take note of what it is that you believe is proof of identity theft.

If you:

- Notice a new, unknown trade line on your credit report

- Receive a piece of mail regarding an account you never opened

- See transactions you didn’t make on your credit card statement

- See transactions you didn’t make on your bank statement

- Find your access to websites such as banks, credit cards, and email accounts has been compromised

You should immediately take note of the specifics of what you are finding.

File A Police Report

Once you have gathered all of your evidence, go to your local police precinct to file an identity theft report.

If your nearest precinct has the ability, you may be able to file a report online.

Make sure to make copies of all supporting documentation in case the police ask for a copy of the evidence and you should have copies for your records and for other steps.

Without a police report, you might not be able to get a new social security number.

File An FBI Id Theft Report

In addition to filing an identity theft report with your local authorities, you should also file a report with the FBI.

The Bureau has created the Internet Crime Complaint Center (IC3) for ID theft cases as well as other crimes facilitated over the internet.

This may not directly help resolve your issue but helps the FBI build its database and profile scams and criminals to hopefully hem.

The IC3 also works with federal, state, and local authorities to ensure the proper authorities receive the information to process the case.

Freeze Your Credit Report With Credit Bureaus

The credit bureaus need to be notified in the event you are the victim of identity theft.

Even if you only think your identity may have been compromised, you can still take action to protect yourself.

If you have a police report you can place and remove a freeze on your credit report without a fee.

In many cases, you can now place a freeze on your credit report without a fee, although you may have to pay a fee to unfreeze it depending on the bureau, state, and other guidelines.

Once you place the freeze, no access to your credit reports can be given which means no new trade lines can be opened.

Here are the links to the credit bureaus:

When you notice an actual fraudulent account on your credit report, you can have it removed.

The Federal Trade Commission has an identity theft letter you can send to the credit bureaus to have them block the fraudulent information within four business days.

The page in that previous link gives you all of the information you need to accomplish this.

Get New Bank Accounts & Credit Cards

Once you have the identity theft police report filed and have frozen your credit reports, the next step is to contact your banks.

Obviously, if you are noticing strange activity you will want to have new accounts opened.

Unfortunately, you will also have to go through the hassle of resetting all of your banking connections like changing the accounts for which you have automatic withdrawals set up and payroll deposits.

Obtain An IRS IP Pin

If you have been the victim of tax-related identity theft you can get an Identity Protection PIN (IP PIN) from the IRS.

Tax-related identity theft is easily identified as you get a rejection notification when you go to file your income tax return with the reason being that a return using that social security number has already been filed for that tax year.

If this has happened to you, you can file IRS Form 14039 Identity Theft Affidavit to notify the IRS of your status as an identity theft victim.

A six-digit IP PIN will be mailed to you each year that must be reported on your income tax return for it to be processed, preventing anyone from committing tax-related ID theft using your information again.

Additionally, if you live in any of these areas, you are eligible for the IP PIN Opt-In Program:

Arizona

California

Colorado

Connecticut

Delaware

District of Columbia

Florida

Georgia

Illinois

Maryland

Michigan

Nevada

New Jersey

New Mexico

New York

North Carolina

Pennsylvania

Rhode Island

Texas

Washington

More states are being added in batches until the program is fully nationwide, so keep checking the IP PIN website.

Misc Identity Theft Protection Tips

- Visit OptOutPrescreen.com to notify all of the credit bureaus that you want to opt out from receiving pre-approved credit card offers (this is good for either 5 years at a time or permanently). This is the only official site at which to do so without going to each bureau individually.

- Ensure that your home network is password-protected. Hackers say that the easiest way to get into someone’s computer is to just roam around a neighborhood scanning for open networks. It takes no effort at all to gain access without any security.

- Keep all computers updated and have anti-virus/malware scanners running at all times. Use automatic update options if you can since security patches are issued regularly and you don’t want to be caught with outdated security protocols.

- Try not to lose sight of your credit or debit card when shopping. If you can’t see the card, you don’t know what the cashier is doing with it.

Wrapping Up

There is no way to guarantee that you will never become a victim of identity theft.

Even if you are one of those people who don’t use credit cards, you still have plenty of ways to fall prey to identity thieves.

What you can do, however, is make it as difficult as possible for unscrupulous people to do you harm.

Be aware of your actions, safeguard your private information, and be proactive when it comes to monitoring your account & activity.

It’s important to remember that it takes multiple tools and methods to protect your identity.

You may want to purchase a credit monitoring service like LifeLock but that alone won’t be enough.

You’ll also want to get something like Credit Karma to check up on your own credit report to look for any anomalies.

And, you’ll definitely want to get LastPass to make sure you are using the most secure passwords (and not the same one for everything)!

Your Turn

Is identity theft a concern for you? What do you do to protect yourself from identity theft? If you or someone you know has been an identity theft victim what can you share about the experience?