Where To Find State Income Tax & State Refund Info

This post may have affiliate links. Please read the Disclosure Policy for complete details.

Wait, what…I have to pay state income tax!?!?

Yes…yes you do.

Almost everyone knows the basics of federal income tax returns like when they’re due, filing extensions, etc. (and if you don’t click on that link to read all about it)

They also know that they can go to the IRS website to find forms, instructions, and answers to most of their questions regarding individual income taxes.

When it comes to state income taxes, however, there’s more confusion since there isn’t a centralized location for the above.

Questions arise such as:

- What are this state’s income tax rates?

- Where is my state refund?

- Do I have to pay state income tax if I’m not a resident?

The problem here is that each state has its own rules regarding state income taxes (if it even has an income tax).

What are you supposed to do?

Come here and use this handy guide to state income taxes and state tax refunds, of course!

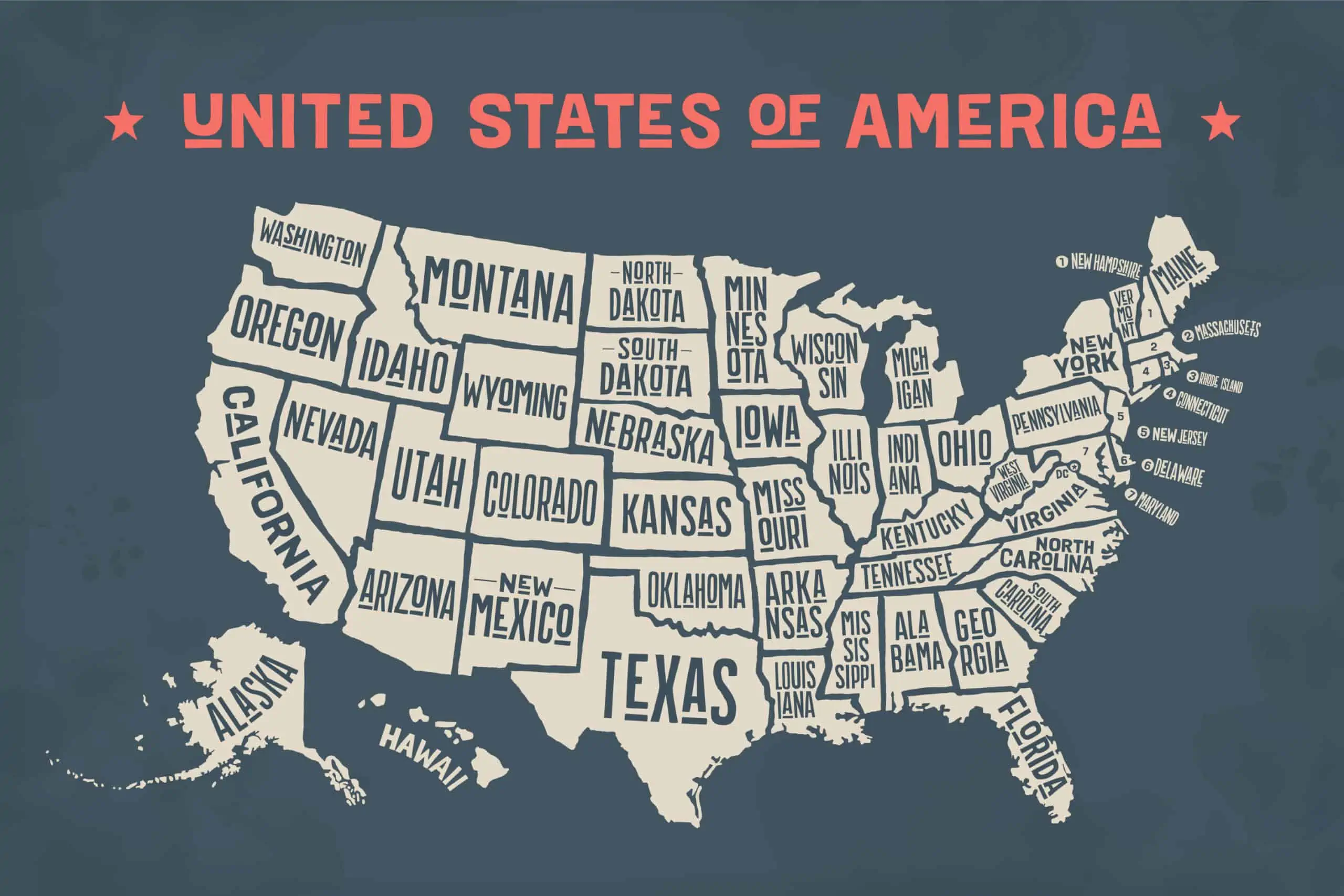

State Income Tax Websites

It’s real simple: just click on your state (or the state you’re interested in learning about) and you’ll be off to that department’s site!

This is where you can find out all about any state’s income tax rules.

Items like:

- Who is required to file a state tax return

- When returns are due

- How to request an extension

- How to pay a tax bill

- What each of the state income tax rates are

- When and how much is needed for estimated state taxes

Alabama

Arizona

Arkansas

California

Colorado

Connecticut

DC

Delaware

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

States With No Income Tax

Keep in mind that not all of them have a state income tax.

There are plenty of states with no income tax at all–not on interest or dividends or anything.

That’s why you might not see the state you live in–or a state you may be looking to move into–on the list above.

The following are the states without income tax:

- Alaska

- Florida

- Nevada

- South Dakota

- Texas

- Washington

- Wyoming

Partial State Income Tax

You’ll notice in the first section that 2 states have an asterisk next to them:

- New Hampshire

- Tennessee

The reason for that is because they “sort of” have a state income tax.

While there are some with no state income tax, these two states tax only a specific type of income.

They don’t tax W-2 wages but do tax your interest and dividends, including certain distributions like from an S Corporation or partnership.

State Tax Refunds

Most state income tax returns are no different than the federal version.

You report your income, take deductions and credits, then calculate how much you owe or better yet get back.

If you get a state tax refund, you can track that just like your federal tax refund–well sort of.

You can check whether or not your state tax refund has been issued and when.

It works for both paper checks as well as refunds that are directly deposited to any financial institution.

Other than that, you can’t get much info, but at least you will get a general idea of what’s going on.

You can check the status of your state tax refund by clicking on the name where you filed a state tax return below to be taken to each one’s Where’s My Refund-type page.

Wrapping Up

State income taxes usually take a back seat to federal taxes, and are sometimes ignored completely!

It’s vital that you are aware of the tax rules not just for the state in which you live, but also for any state in which you sent time and earn money.

Each state’s tax rules can vary widely, so it’s key that you pay close attention, and don’t forget about state income taxes!

As always, if you aren’t sure if you are doing things correctly make sure to consult a qualified tax preparer for assistance.

Your Turn

Have you ever had to look up state tax return info only to waste time on numerous dead-ends? Did you know that there are Where’s My Refund-type lookup tools for state tax refunds (honestly, I had no idea!)?