1 Money-Saving Tip That Actually Helps You Save Money

This post may have affiliate links. Please read the Disclosure Policy for complete details.

Many more than just one money-saving tip is floating around the web, from many money experts.

Look for and use promo codes.

Cut the cable television.

Cook at home using cheap grilling ideas instead of dining out.

Only drink water if you do go out.

Make your own coffee.

It seems like everywhere you turn someone has something to say about saving money.

Don’t get me wrong, saving money is great and the people giving the advice are just trying to help.

But almost every money-saving tip just repeats what others have said a million times already.

Plus, there is a fatal flaw…

Spending less or not spending is not the same as “saving money”.

That money-Saving Tip Isn’t About Saving Money

The problem is that almost every money-saving tip is pretty generic in nature.

More importantly, they actually fail to address the fundamental issue.

The definition of saving is “preserving” so you aren’t actually saving if you are taking money that wasn’t spent on one thing just to spend it on something else.

Most people, when they talk about skipping the latte or brown-bagging lunch, simply stop at that.

What’s the next step?

What do you do with the money you don’t spend when you make coffee at home instead of stopping at the store.

What about the money you “save” using coupons?

In essence, they are just showing you how to not spend money.

That is totally different than saving money!

And while it may seem a bit nit-picky to make that distinction, it’s necessary because people will leave that money in their checking account and simply spend it on something else they deem more “appropriate”.

Let’s also be real for a moment; many people also need explicit instructions too.

That really doesn’t help when you are trying to actively save money.

It’s similar to so many “listicles” that simply list things you can do but never go into any detail about how to do any of them.

The Financial Goal I Was Saving For

Here’s a little backstory into my past and how I came up with this process before we proceed.

In 2014 I was pretty much at my wit’s end working for the CPA firm I was with.

The people in the office were nice enough.

I do enjoy preparing income tax returns.

But, I was tired of dealing with those clients as well as the long hours and unnecessary BS simply because “it was tax season” or something else.

I decided in December that I was done, and gave my boss the date of July 15th, 2015 as being my last day.

(That specific day was chosen because it would give me one last tax season of overtime plus he always took off 2 weeks after April 15th so it would give him time to get back into the swing of things and find a replacement)

So, I had 6 1/2 months to start getting my finances in order and was brainstorming for a way to do it and actually build savings.

Now, I didn’t have a specific figure in mind but I was going to take a pretty generic approach: save everything I could!

For me, it all started with a savings account.

I knew I was going to have a savings plan at some point, but it would do no good to save money if there was no decent place to keep it.

That meant leaving it in my regular checking account mixed with my everyday money wouldn’t cut it.

It also meant using a regular old financial institution for a savings account wouldn’t do it for me either.

I mean, who the heck wants to earn .01% from a national or regional bank?

Even though the rates at most online banks aren’t going to make you rich, it’s still better to earn .80%-1.00% vs. practically zero.

Saving Money Means Having A Plan

Once I got the savings account in place, the next step was actually saving money to put into it.

As I stated earlier, I was going to keep my money-saving plan as simple as possible and just save everything I can.

Since this was going to be my “survive until my new business starts making a profit” fund, I was completely ok with just dumping cash into it without any specific target in mind.

You may actually have a goal with a specific dollar target such as:

- Becoming a first-time home buyer

- A vacation fund

- Education for your child(ren)

- Funding your retirement plan (ie: Roth IRA)

Even though I didn’t have a dollar target in mind, I did have a plan as to how I was going to be saving money.

So what was this amazing money-saving tip?????

My Money-Saving Tip For You

Ok, so I set the stage and now it’s time for the big reveal.

My big money-saving tip is…

SAVE YOUR MONEY!

That’s what I did.

I moved money into a savings account every time I:

- Used a coupon

- Got a discount

- Decided against spending

- Got overtime

- Got extra money

It sounds so simple, but no one ever tells you to do it.

You hear a lot of “don’t buy so and so” or “make sure to use a coupon” or something else about not spending, but that is all it is.

It’s all about not spending or cutting out certain things only to spend the money on other, more “acceptable” purchases.

There is never talk about actually saving money.

Let’s see how my “unique” money-saving tip was put into action.

Saving Money in Action

This first part of my plan may be specific to me and not apply to everyone.

I understand that financial advice isn’t universal so if this part doesn’t apply to you, don’t worry, I’m not judging.

I happened to get paid overtime during tax season, so I took the difference between my regular paycheck calculation and the overtime periods, then transferred the difference to my savings account.

By moving all of the “extra” money I made via overtime it was as if I never had that money, to begin with, so I wasn’t going to miss it.

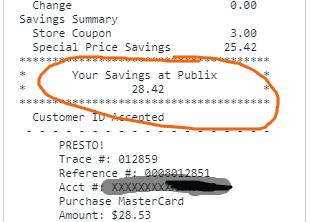

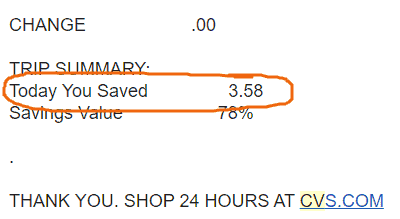

When I would save money with a coupon–say $10 off at checkout–then I would transfer the amount of that coupon to my savings account.

When I went to the grocery or drug store, they usually put the “amount you saved” at the bottom, so I would transfer that to the savings account as well.

I would also transfer the money I decided not to spend–like if I was considering buying a shirt or going out to dinner but decided against it.

All of the money that remained in my checking account from savings with coupons or not spending isn’t considered “saving” if I only turned around and used it for other purposes, so I have to move it to the savings account for it to truly be called “savings”.

Since many people need to gamify their methods of saving money, this should be quite easy!

It’s all about taking action, not just being told “don’t spend” or “use coupons” ????

Wrapping Up

I’ve said it a few times, but it bears repeating:

Many money-saving tips aren’t helping you to save money, just to not spend on certain things only to spend the money on what the person giving the advice thinks you should be spending that money on.

In order to save money, you need to take further action and actually move the money that you aren’t spending into a vehicle where you are building wealth.

Using that money to contribute to retirement savings is a good option as well, or building a CD ladder or emergency fund.

Leaving the money in your everyday checking account really isn’t doing anything to help you “save money” at all.

Your Turn

Do you think there’s a difference between saving and not spending? Do you take the extra steps of setting up a separate account for specific financial goals or do you just leave all your “saved money” in your everyday account?

this was a pretty genius tip and incredibly not one i’d ever heard before. thank you!!

Thanks Lindsey 😁