Paycheck Calculations: How Your Final Pay Is Determined

This post may have affiliate links. Please read the Disclosure Policy for complete details.

The income tax return and tax refunds get most of the attention when it comes to tax-related discussions.

The problem with that is for the majority of people, the main component of that is the paycheck, and that is something so many people don’t understand.

When you get your first paycheck you’re super excited.

You can’t sleep the night before.

You’re full of excitement for your employer to run payroll and have a payroll check with your name on it.

All sorts of ways to spend it run through your mind.

The last thing that you ever consider is how paycheck calculations are done and payroll deductions will affect you.

Then you open the envelope (or log into the website) and see something surprising.

Your paycheck is much less than what you thought it would be.

Welcome to the world of how the payroll department calculates paychecks!

You never get 100% of what you earn, and in some cases, it may seem like you aren’t even taking home half!

The hard truth is that you actually may not be very far off.

Here, we will take a look at how paycheck calculations work for the most common situations mostly for new entrants to the workforce but also for those who simply want to understand their personal finances a bit better.

This isn’t going to be a step-by-step breakdown of how paycheck calculations are done for every situation.

Instead, it’ll serve more as an overview so when you look at your paystub you will recognize the payroll deductions listed and have a better understanding of why your take-home pay is what it is.

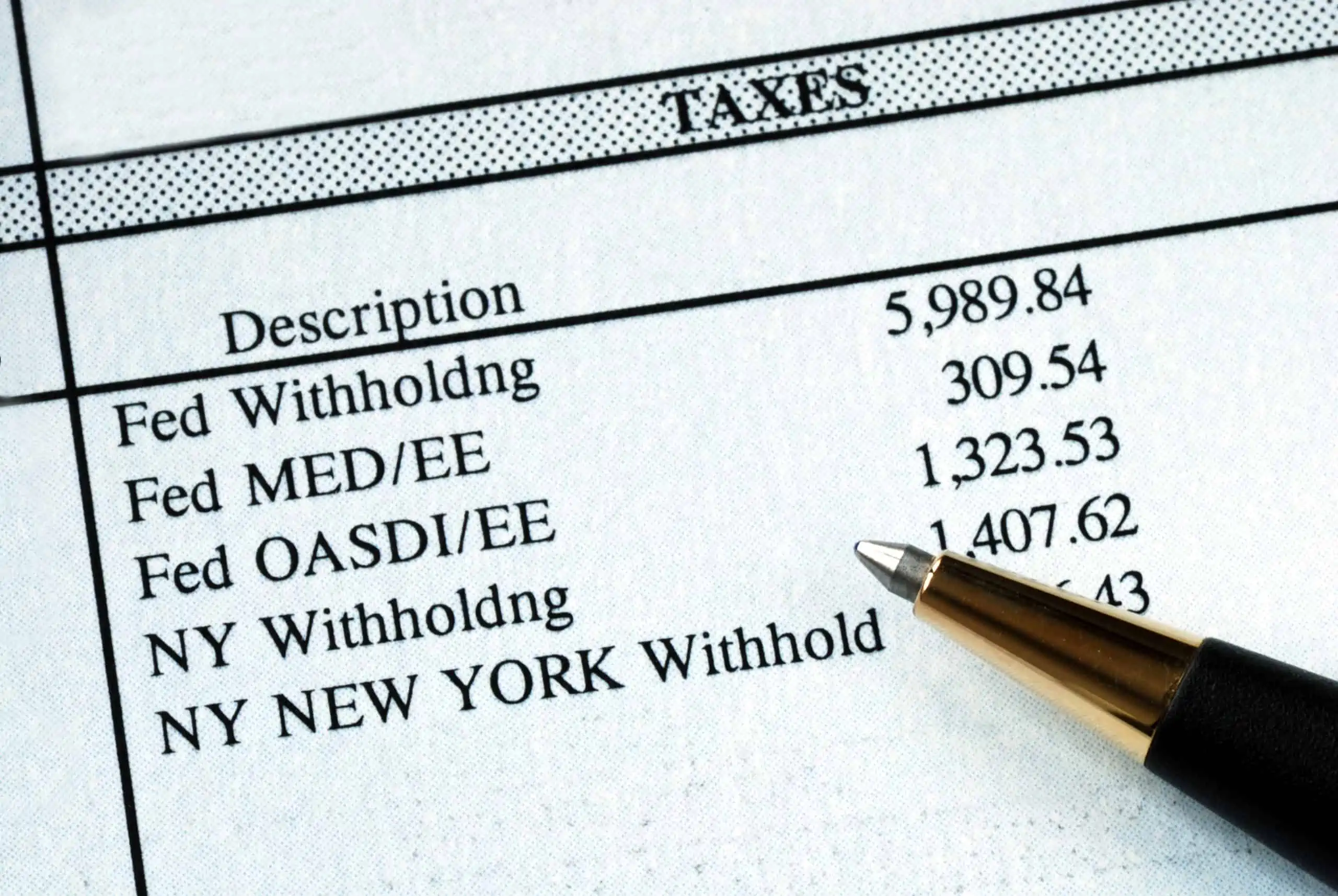

Common Payroll Deductions Affecting Paycheck Calculations

When talking about why your take-home pay is lower than you anticipate, this is where to start.

For the majority of people, there are going to be the 3 major payroll deductions:

- Federal withholding

- Medicare

- Social Security

Sometimes you will see Social Security listed as OASDI (Old-Age, Survivors & Disability Insurance) which is the official designation of the program.

Medicare may also be referred to as the hospital insurance tax.

Both Social Security and Medicare make up the FICA tax or Federal Insurance Contributions Act.

The FICA calculations are pretty straightforward:

- Social Security is 6.2% of your taxable wages up to the annual limit

- Medicare is 1.45% of your taxable wages

Each year the SSA sets a limit, which when reached means you stop paying social security tax and is determined by a cost of living adjustment each year.

There is also an additional Medicare tax of .9% for people who earn over $200,000 and that applies once that limit is crossed.

The federal withholding is a variable figure from person to person and at its core is based on these factors:

- Earnings (either based on salary or hourly earnings)

- Form W-4 adjustments

- Payroll period (ie: weekly, biweekly, twice monthly, etc.)

You can use IRS Publication 15-T to see how your federal withholding is being determined.

Payroll Calculations On Bonuses

There are times when you may get a bonus paycheck.

It could be a holiday bonus or a year-end bonus.

It could be at the completion of a particularly busy season–for example, I would get a bonus at the end of each tax season.

It could be the result of the boss wanting to reward employees simply for doing a good job.

These payments are subject to all of the same taxes as your regular check.

Except for one difference.

Many people have asked me why their “bonus” paychecks seem to have more federal withholding taken out than their regular paychecks.

Everything else looks to be in line with the normal paycheck calculations, but they almost always notice a significantly higher federal withholding amount.

This is because bonus payroll checks often have a federal withholding rate of 22% called the “supplemental wage rate”.

The reason for this increased federal withholding rate is due to the fact that bonuses are generally issued outside of the regular payroll processing.

These “extra” paychecks can lead to you being pushed into a higher tax bracket without recalculating the rest of your payroll going forward.

Because your regular paychecks aren’t going to reflect this addition to your income, the IRS wants to make sure you are paying enough to cover your tax obligation.

Therefore, bonus paychecks have a higher federal withholding rate associated with them.

Employee Benefits Package & Paycheck Calculations

Sometimes you get lucky and the job you secure has any kind of employee benefits package attached to it.

These can include (but aren’t limited to):

- Retirement (ie: 401(k))

- Health Insurance

- Sec 125 (Cafeteria Plan)

- Paid Time Off

These benefits can affect your paycheck calculations and, ultimately, on your take-home pay.

Sec 125 (Cafeteria Plan) plan contributions, for example, are pre-tax which means that money is subtracted from your gross earnings before taxes are calculated.

Basically, that means you aren’t paying any taxes (including state income tax) on that portion of your income.

Your Traditional 401(k) contributions on the other hand are only exempt from federal, state, and local withholding, but not from FICA taxes (Social Security and Medicare taxes).

That means when your payroll deductions are calculated, your Traditional 401(k) contributions are excluded from the federal withholding calculation but are included in the Social Security and Medicare Tax calculations.

It’s important that I specify the above as “traditional” because Roth 401(k) contributions are after-tax contributions and do not affect your taxes, but still reduce your take-home pay.

Group health insurance, if not paid by your employer or from your Sec 125 plan, is an after-tax deduction that doesn’t reduce any of your payroll taxes.

Some People Are Exempt From Payroll Deductions

Not everyone is going to be subject to all payroll deductions.

If you are a student employed by a school (university or college) where you are actually enrolled, then you are exempt from FICA deductions.

For example, when I was in college I worked for the dean of my major’s department, and only federal and state withholding was taken from my paychecks.

Another group that is going to be exempt from certain taxes is active military service people.

If you’re sent to a combat zone, the wages you are paid for each month present during that time are going to be exempt from federal withholding–combat pay is still taxable for FICA taxes.

Another situation to be aware of is the family/employment relationship.

There are some instances where certain arrangements lead to exemptions from certain paycheck calculations, while other arrangements lead to no changes in paycheck calculations.

The best way to determine how your situation may be affected is to go directly to the IRS website for concise explanations.

Small Companies & Paystubs

There are many small businesses that simply refuse to use a payroll service.

Instead, they insist on doing their paycheck calculations on a sheet of paper or a spreadsheet and then writing a check.

I find that to be a poor way of doing things because you don’t get to see that breakdown of the payroll deductions for yourself.

You essentially have to trust that whoever is doing the payroll is indeed doing it correctly.

On top of that, you aren’t able to work with your tax preparer for planning since you don’t see how much you’ve made or paid in federal or state withholding.

It’s not “illegal” to operate this way, but it is wrong in my opinion.

So why am I mentioning this?

So that people know that they aren’t the only ones in this type of situation and that it’s ok to ask for a paystub or some kind of report each pay period so you can verify the paycheck calculations and also know what you’ve earned & paid.

Wrapping Up

To bottom line it for you:

No one who is an employee ever takes home 100% of what they earn.

There is almost always some sort of payroll deductions that reduce your take-home pay.

You need to be aware of this and understand how paycheck calculations work so that when you see your actual paycheck or the direct deposit at your financial institution, you know why it’s that amount.

You’ll be better at managing and budgeting money when you can more accurately predict what you’ll be bringing in.

And, you won’t be as disappointed because you’ll have this knowledge and won’t be expecting something that never was going to happen!

Your Turn

I guess the most important question is do you even look at your paystubs or just at the check/bank deposit amount? Do you have a better understanding of how paycheck calculations work after reading this?