Unclaimed Property: How To Get Your Lost Money Back

This post may have affiliate links. Please read the Disclosure Policy for complete details.

Unclaimed property.

Unclaimed funds.

Unclaimed money.

No matter what anyone calls it, it’s a bad thing.

Why?

It means you lost the ability to use your own money.

It also means you have no idea where your money is if it’s considered to be unclaimed funds.

That can compound your problems managing finances, too.

Quite simply, this subject doesn’t need a large opening or any cutesy story to set the stage so let’s jump right into discussing unclaimed property!

What is Unclaimed Property (a/k/a/ Escheatment)?

In simple terms, unclaimed property is cash and equivalents that have been abandoned or unclaimed and turned over to the state.

The technical term is called escheatment and dates back to Feudal England.

It’s the term for the process by which people would attempt to get back property from the Crown when a family member passed away without heirs.

Today, its application is a little broader.

The escheatment process applies to unclaimed property in general terms, not specifically those of deceased people.

And while it may sound like all property would fall under the umbrella of escheatment, it doesn’t apply to cars, homes, boats, etc.

Additionally, the individual states dictate the laws regarding unclaimed property and escheatment versus the Crown (federal government in the U.S.).

How Unclaimed Property Gets Reported

Now that we know what unclaimed property is, let’s look at how your assets get to the state to be classified as unclaimed property.

When the accounts go dormant, or when the owners of the accounts can’t be located, the money in, or the value of the accounts, gets transferred to each state to hold.

For example, if you move and forget to close out an account at your local bank, after 5 years (depending on the state) of dormancy, the funds will be sent to the state for holding as unclaimed property.

The same thing happens when the beneficiary of a life insurance policy doesn’t notify the insurer of the passing to claim the proceeds.

For brokerage accounts, the brokerage is required to make a “diligent” effort to find the owner of the investment account, and after the state-specified abandonment period, the account goes to the state.

That’s why it’s important to always be diligent when it comes to your money.

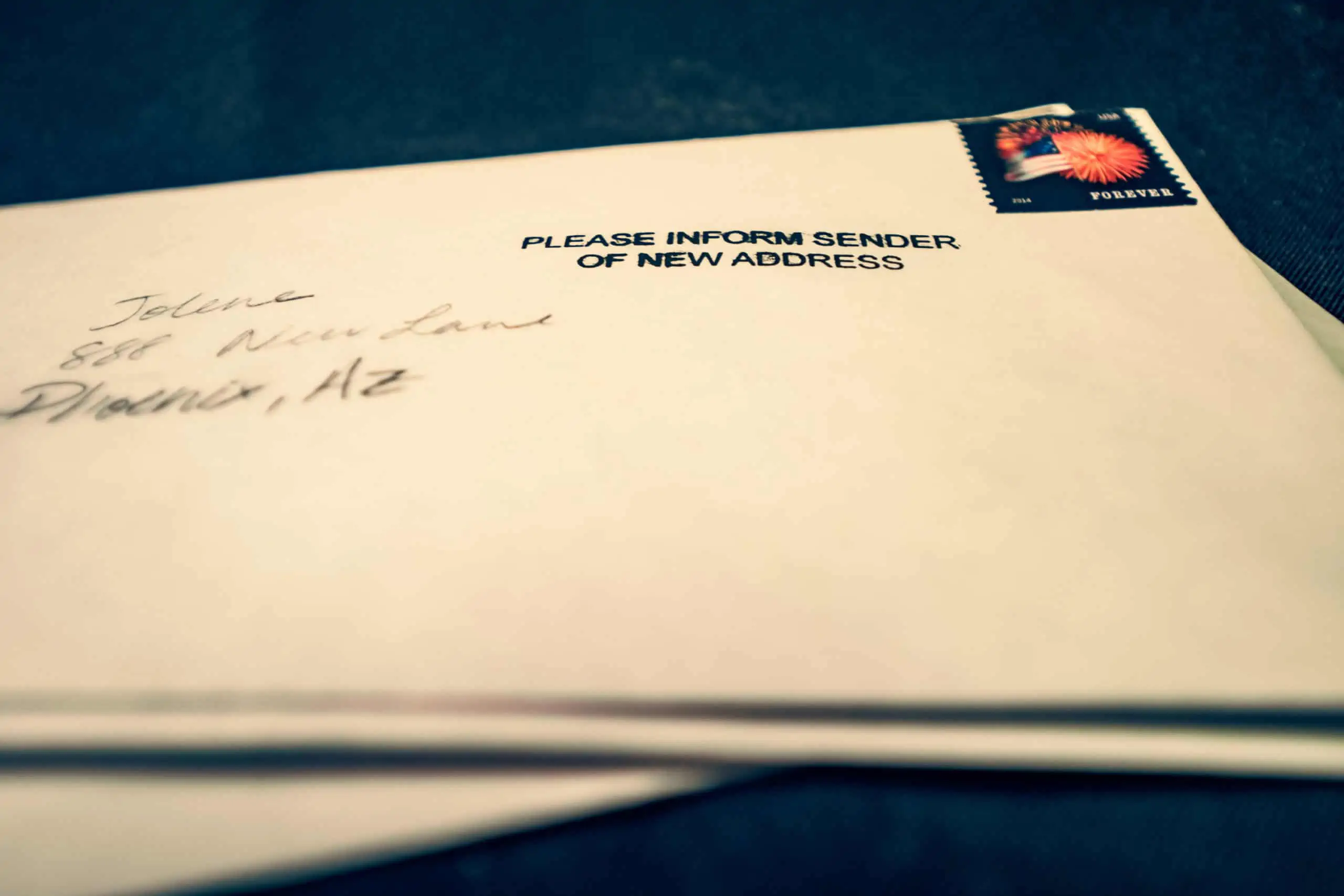

You should always know where you have accounts and make sure to notify anyone you have any kind of financial relationship with of a change of address (even if it’s just around the corner):

- Banks

- Brokerages

- IRS

- States taxing agencies

- Insurance companies

If you don’t make these notifications, and you forget to close out accounts or the attempts to notify you are returned (or fail), then your assets will end up being reported to the state’s unclaimed funds unit(s).

What’s Included In Unclaimed Funds?

Your next question is probably a common one:

What kinds of funds get sent to the state to be held as unclaimed property?

Well, you’re in luck as I have the answers to that question:

- Dormant accounts at financial institutions

- Savings accounts

- Checking accounts

- Certificates of Deposit

- Safe deposit boxes

- Uncashed money orders & bank checks (some states)

- Investments

- Brokerage accounts

- Uncashed dividend/distribution checks

- Direct stock certificates

- Security deposits

- Utility bills

- Housing

- Insurance proceeds

- Life insurance

- Annuities

- Payroll checks

That’s pretty much all of the accounts that qualify.

Real estate, as many people are wondering about, is not something that qualifies for unclaimed property holding.

Searching For Unclaimed Property

I’ll be honest…seeing as how we are dealing with state governments with unclaimed funds, I had low expectations.

I mean, I’ve looked at a lot of state websites to research things like state income taxes or limited liability company formation and many are just plain crap.

When it comes to searching for unclaimed property, however, the sites are mostly intuitive and easy to use.

The process for searching for unclaimed funds is easy too.

Just start by clicking on the state(s) where you have ever lived below.

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

DC

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Then you simply enter your name and you’ll be presented with a list of any unclaimed property in your name.

Then you follow the instructions to file your claim for those unclaimed funds and wait.

Each state has its own methods, requirements, and timeline for recovering unclaimed funds so make sure to pay attention so you don’t delay the process unnecessarily!

Other Types of Unclaimed Property

State unclaimed property isn’t the only path to finding money that you may have lost or forgotten about.

Some other types of unclaimed funds include savings bonds and/or treasury bonds that can be researched using the US Treasury’s Treasury Hunt tool.

If you think you may be owed a refund of an income tax return, you can contact the IRS to inquire about that payment.

For people who were the victims of bank or credit union failures you also have resources:

- National Credit Union Administration: unclaimed deposits list

- Federal Deposit Insurance Corporation: unclaimed funds database

Harmed investors who are supposed to be recipients of settlements or other SEC actions have a database to refer to searchable by case.

Wrapping Up

As I stated in the opening, the topic of unclaimed property doesn’t require an entire song and dance!

In my opinion, everyone should sit down and spend a little bit of time searching for their own unclaimed funds and even for members of their family.

If you come up with nothing, that’s great because you know that you aren’t missing out on anything.

If you do end up finding something, that’s great, too, because then you can take the steps to claim those unclaimed funds to make yourself or your family member(s) whole again.

So here’s a great money-saving tip: make sure you close out local accounts and notify every institution you have any kind of financial relationship with of your moves so you don’t get stuck dealing with this!

Your Turn

Have you ever done an unclaimed property search? What was your outcome? If you did discover unclaimed funds in your name, did you follow up and file a claim, and what was the experience like?